Classifying Stablecoins

2/17/2025

Introduction

In this blog post, I want to take a different approach to classifying stablecoins, compared to the typical breakdowns you might find online. I’ll be categorizing them into three distinct types: centralized, decentralized, and hybrid.

For those unfamiliar with stablecoins, they are cryptocurrencies designed to maintain a constant value of $1.00. Essentially, they function as digital dollars. While most stablecoins are pegged to the U.S. dollar, some mimic other fiat currencies like the euro, yen, or Australian dollar. Stablecoins are arguably one of the most practical applications of crypto, as they provide a reliable, non-volatile medium of exchange.

I believe stablecoins have the highest potential for real-world adoption in everyday transactions—especially when compared to volatile assets like BTC. Since stablecoins retain a stable value, individuals and businesses are more likely to use them for payments, savings, and financial operations, just as they do with traditional fiat currencies.

Key Benefits of Stablecoins

- Wealth preservation in developing countries:Stablecoins provide a way for individuals to protect their savings from local currency devaluation. Holding USD-denominated stablecoins can offer greater stability compared to inflation-prone national currencies.

- Convenience for crypto traders:Traders use stablecoins to consolidate profits, manage risk, and quickly move funds within the crypto ecosystem.

- Access to decentralized finance (DeFi):Stablecoin holders can participate in DeFi opportunities, such as lending, liquidity provision, and yield farming. Some DeFi platforms offer yields exceeding 10%+, creating financial opportunities that were once limited to banks and institutional investors.

Centralized Stablecoins

Centralized stablecoins are cryptocurrencies managed, minted, and redeemed by a real-world company. These organizations control the issuance and backing of their stablecoins, ensuring (ideally) that each token is fully backed by traditional financial assets.

I won’t be assessing the trustworthiness of these stablecoins here—my goal is simply to explain how they work. Their mechanism is fairly straightforward:

- Companies hold reserves in bank accounts and U.S. Treasury bills, aiming to maintain a 1:1 backing ratio with the issued stablecoins.

- Users can redeem their stablecoins by returning them to the issuing company, which then credits the equivalent amount in USD to the user’s bank account.

Some of the most widely used centralized stablecoins include:

- USDT – Issued by Tether, one of the oldest stablecoins ($142 billion issued).

- USDC – Issued by Circle ($56 billion issued).

- FDUSD – Issued by First Digital Labs ($6 billion issued).

- PYUSD – Issued by PayPal ($637 million issued).

- TUSD – Issued by Archblock ($494 million issued).

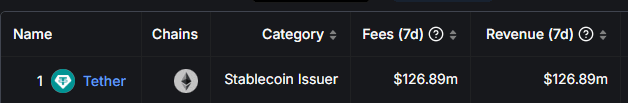

Running a centralized stablecoin business can be highly profitable. Since many issuers hold reserves in interest-bearing assets like U.S. Treasury bonds, they generate passive income without actively engaging in traditional business operations. For example,Tether (USDT) owns more U.S. Treasury bills than any single country and operates with a team of only around 100 employees—yet it earns billions in profits.

Other examples of centralized stablecoins include USD0, Ondo, USDD, USDP, BUSD, and GUSD.

Screenshot of Tether revenue for the past week from DefiLlama, $127M profit a week isn't too shabby.

Decentralized Stablecoins

Unlike centralized stablecoins, decentralized stablecoins are not issued or controlled by a single company. Instead, they operate autonomously through smart contracts on a blockchain, without reliance on a central authority.The most common type of decentralized stablecoin is a Collateralized Debt Position (CDP) token. To mint a CDP stablecoin, users provide cryptocurrency—typically Ether (ETH)—as collateral. In return, they receive newly minted stablecoins. If the price of ETH falls significantly, the CDP protocol automatically liquidates the position by selling the collateral to ensure the stablecoin remains fully backed at $1.00.

The reason these stablecoins maintain their peg is simple: at any time, a user can redeem (or burn) their stablecoins in exchange for an equivalent value in another cryptocurrency. This mechanism ensures that the stablecoin always retains its intended value.

It's important to note that CDP-based stablecoins can have different mechanisms and risk factors, depending on how they are designed.

Some examples of mostly decentralized stablecoins include:

- LUSD – Liquity USD, with a market capitalization of approximately $58 million. LUSD maintains its peg through an over-collateralization mechanism using Ether.

- sUSD – Synthetix USD, with a market capitalization of around $18 million. sUSD is minted by staking SNX tokens and is used within the Synthetix platform for trading synthetic assets.

- MIM – Magic Internet Money, (a personal favorite) with a market capitalization of approximately $104 million. MIM is issued by the Abracadabra protocol, allowing users to borrow against interest-bearing crypto assets.

- RAI – Reflexer, with a market capitalization of about $3.4 million. RAI is an ETH-backed stablecoin that is not pegged to any fiat currency, aiming for autonomous stability.

- alUSD – Alchemix USD, with a market capitalization of approximately $15 million. alUSD allows users to obtain advance yield by minting stablecoins against future yield from deposited collateral.

- XAI – Silo Finance's stablecoin. XAI is designed to be a decentralized stablecoin with unique collateralization mechanisms.

- crvUSD – Curve Finance's stablecoin, with a market capitalization of approximately $71 million. crvUSD utilizes a lending-liquidating AMM algorithm to maintain price stability.

Decentralized stablecoins operate autonomously through blockchain code, enhancing transparency and reducing censorship risks. However, their stability hinges on the value of their crypto collateral, which can be volatile. Therefore, strong liquidation mechanisms are essential to promptly address undercollateralized positions and maintain the $1.00 peg. Users must balance the benefits of autonomy and transparency against the challenges of ensuring consistent value stability.

Hybrid Stablecoins

These are stablecoins that use a mix of centralized and decentralized mechanisms to maintain their $1.00 peg. They may be backed by both on-chain crypto assets and off-chain reserves or use algorithmic elements alongside collateralized assets. The goal is to combine the benefits of both models—having some level of decentralization while still ensuring stability through real-world backing or other mechanisms. A common example of hybrid stablecoins is those that primarily use crypto collateral but include centralized stablecoins like USDC or USDT as part of their reserves. This can improve liquidity and peg stability but also introduces reliance on centralized assets. Another approach is fractional reserve models, where only part of the stablecoin supply is backed by collateral, with the rest managed through algorithmic means. Some examples of hybrid stablecoins include:- DAI – Initially a fully decentralized stablecoin backed only by crypto collateral, but over time, a significant portion of its reserves has included USDC and other centralized assets. (~$4.8 billion)

- FRAX – Uses a fractional reserve model, with part of its backing coming from crypto collateral, some is algorithmically stabilized, and partially backed by real world assets like treasury bonds. (~$688 million)

Hybrid stablecoins have trade-offs. They can offer more liquidity and stability than purely decentralized stablecoins, but they also introduce some exposure to centralized assets, which may carry regulatory or counterparty risks. However, they are still distinct from fully centralized stablecoins since issuance and redemption typically happen through smart contracts rather than a single entity.

Stablecoin Trilemma

This graph portrays the rating of USDC, LUSD, and DAI in regards to decentralization, stability, and capital efficiency on a scale of 1-10.

Some stablecoins prioritize decentralization, ensuring they operate without reliance on a central entity, but this can sometimes come at the cost of stability and efficiency. Others are highly stable and efficient, making them easier to use for transactions and liquidity, but they may rely on centralized control. Every stablecoin falls somewhere along this spectrum, balancing these three aspects differently.

In the next section, I’ll break down what each of these factors means and how they impact the way stablecoins function.

- Decentralization:This refers to how independently a stablecoin operates without relying on a central company. On the far end of centralization, you have USDC, issued by Circle, a heavily regulated U.S. company. No stablecoin today is fully decentralized—even the most decentralized ones rely on external price feeds to determine asset values. CDP-style stablecoins, for instance, require accurate price data to manage liquidations. These protocols often use semi-decentralized services like Chainlink to provide this data, introducing some level of centralization. However, some stablecoins reduce risk by using multiple oracles, preventing a single point of failure. A notable example is LUSD, where users deposit Ether (ETH) as collateral and borrow LUSD.

- Stability:Stability measures how consistently a stablecoin maintains its $1.00 peg. The only stablecoin that has never depegged is USDT. Others, like USDC, generally hold their peg but have experienced temporary deviations. For example, when Silicon Valley Bank collapsed, Circle had exposure to the failed bank, causing USDC to briefly drop to $0.96 due to market fears. Decentralized stablecoins, on the other hand, can experience price fluctuations due to market supply and demand imbalances in liquidity pools. More severe depegs can happen if collateral values drop too fast, liquidations lag behind, or price oracles fail to update quickly. While most depegs are temporary, holders should be aware of these risks.

- Capital efficiency: Refers to how effectively a stablecoin can use its reserves to generate yield or maintain liquidity. In traditional finance, banks take deposits and lend them out to earn interest, while centralized stablecoin issuers like Tether (USDT) and Circle (USDC) generate revenue by holding reserves in interest-bearing assets like U.S. Treasury bonds. This is why Tether, despite having only about 100 employees, is raking in billions—its reserves work for it. On the decentralized side, capital efficiency is often lower since CDP stablecoins like DAI or LUSD require overcollateralization, meaning users have to lock up more value than they mint. This makes them more resilient but less efficient in terms of capital usage. alUSD (Alchemix USD) is an interesting outlier here—while technically a CDP-style stablecoin, it takes a unique approach by allowing users to mint alUSD against future yield. Deposited collateral (such as DAI or ETH) automatically earns yield, and over time, that yield repays the debt. This effectively increases capital efficiency because instead of simply sitting idle as locked collateral, the assets are generating returns that pay off loans over time. Hybrid models like FRAX also attempt to optimize capital efficiency by using a fractional reserve system, mixing crypto collateral with real-world assets to generate yield while maintaining stability. The trade-off? More efficiency can sometimes mean more risk—whether that’s exposure to centralized assets, reliance on algorithmic stability mechanisms, or, in the case of alUSD, assumptions about future yield sustainability.